Wage shares fall in the US, Germany and many other countries while financial shocks hit emerging economies says Yilmaz Akyuz discussing repercussions and imbalance in the global economy on the back of US and Europeanmismanagement of the 2008 financial crisis.

February 21, 2014 Produced by Lynn Fries

TRANSCRIPT

LYNN FRIES, PRODUCER: Welcome to The Real News. I’m Lynn Fries in Geneva.

We’re continuing our conversation with economist Yilmaz Akyüz on his view of why the 2008 financial crisis is taking too long to resolve and how crisis management in the U.S. and Europe is creating more problems than it’s solving. Yilmaz Akyüz is chief economist at the South Centre and former director at UNCTAD in the Division on Globalization and Development.

Yilmaz Akyüz, thank you for joining us.

YILMAZ AKYÜZ, CHIEF ECONOMIST, SOUTH CENTRE: Thank you for inviting me.

FRIES: In part one, you said two major policy shortcomings–fiscal austerity and a reluctance to remove debt overhang through a proper restructuring–meant excessive reliance was put on monetary policy. And we had the first problem from that policy response coming out of the emerging economies in the South. Let’s pick it up there.

AKYÜZ: Well, I think the main responsibility is policies in the United States and Europe. There has been excessive reliance on monetary policy, with central banks going into uncharted waters, including zero-bound interest rates and rapid extension of liquidity. We still don’t really have very much in the United States in stimulating spending and generating jobs. But it has actually triggered massive outflows of capital from these countries to developing countries, and in particular the so-called emerging markets. And this inflow of capital supported the consumption boom. It led to appreciation of currencies and widening of current account deficits in those countries.

Now that, of course, the easy money is still with us. The U.S. has not really gone from monetary easing to monetary tightening, because what’s happening is that with QE tapering [incompr.] only monthly additions have declined. But the markets have priced in the end of the easy money. And this is why we have a sudden decline in capital flows to emerging economies, and in some cases reversal, putting many of them with large debt and deficits into stress and significant drops in stock markets, significant drops in currencies. And that is really a problem.

Of course, the emerging market economies were also responsible for that, because they did not really manage these inflows properly. And IMF actually did not give them proper advice. On the one hand, IMF joined the hype that these countries became quite autonomous, independent of the North, and therefore underestimated the vulnerability of these countries to the swings in policies in the United States. On the other hand, even when capital inflows were causing serious problems in the emerging markets, IMF told them that you should avoid capital controls to the extent possible and use them only as a last resort and on a temporary basis. This is where we got today now.

FRIES: In your paper, you say the myth of decoupling of the emerging economies from that of the advanced economies has been demolished. Talk about that.

AKYÜZ: Well, in a matter of a few years, what we’ve seen is the rise and the fall of the South. There was a hype that emerging economies are rising, they are decoupled from the advanced economies, and major emerging economies are becoming global locomotives and drivers for the world economy.

This hype actually was started by financial markets when they invented BRICS, as the most dynamic emerging economies. This rise of the South concept was a sort of a validation of the globalization process. But we know that advanced economies are very selective about globalization. They do not allow freedom, full integration in all respects. They put a lid on intellectual property rights, technology transfer. But they allow free movement of capital, they allow free movement of goods and services in which they have competitive advantages. Developing countries, on the other hand, they have rapidly integrated into the international system, both in trade and finance.

FRIES: And what lessons do you see from all of this?

AKYÜZ: Now, this crisis shows two things.

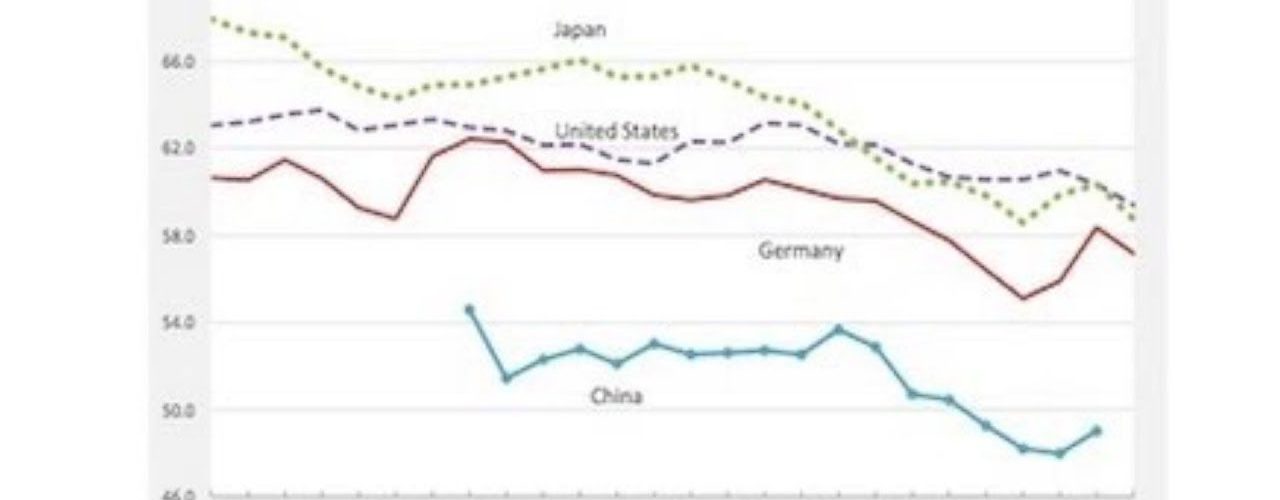

One, the dangers of excess dependence on foreign markets. This lesson must have been learned by China and others, who are excessively dependent on foreign markets for domestic production. They are keeping a lid on their domestic demand and trying to export their way out, and, in fact, underconsumption is as much a problem, even a bigger problem in China than in Germany, U.S., in Japan and other advanced economies. So this one lesson, that you have to have the domestic and foreign forces of growth to be balanced.

Secondly, we’ve become excessively dependent on international capital, and that means mostly Latin American countries. And they’re running large deficits, but also some countries as well in Africa and Asia.

I’m not advocating that countries should close their doors, but I’m saying that they should actually exploit foreign markets, foreign capital, foreign technology in the service of their development, and they should not simply open up and integrate into the world economy in a way much closer than is done by some advanced economies, particularly in the area of finance and trade.

FRIES: Let’s go back to your opening comments on the world economy and your view that a fundamental systemic problem is a deflationary gap. If I understand you correctly, you’re saying the underlying problem didn’t go away but accumulated over time, built up into financial fragilities and trade imbalances. Talk about where we are now with these trade imbalances

AKYÜZ: I talked about the deflationary gap and I talked about the global deflationary gap. Of course, a manifestation of this deflationary gap particularly is the trade imbalances. In countries such as the U.S. which have been running large deficits, there are very large deficits not because they solved the underconsumption and income distribution problems but because they had bubbles, and the same with the U.K., same with some developing countries who relied upon bubbles.

Now, with all these countries, inequality is a problem, underconsumption is a problem. And now actually the main problem has come up in Europe, in Germany. Now, few years back, everybody’s attention was China running huge surpluses, which reached 10 percent of GDP at the peak. Now, that was totally and clearly unsustainable. And, in fact, if you look what happened to China since 2007, Chinese surplus fell rapidly from 10 percent of GDP to around two, two and a half percent, not because China has improved income distribution or overcome the underconsumption problem, but they had a bubble, an investment bubble. So you have again underconsumption problem is actually resolved by a bubble, in China, investment bubble.

China has been replaced by Germany. Germany is now running 7 percent surplus, which amounts to $260 billion and 7 percent of its GDP. Germany is even running surplus vis-à-vis China, something which is quite difficult. And German domestic demand has constantly lagged behind income, and German wages have constantly lagged productivity growth. That means that it’s deflating domestic prices and wages to gain competitive advantage. And Germany has been relying on export for growth more than anyone else today.

Now, before the crisis, a large proportion of German surplus was vis-à-vis European periphery countries. But since the financing dried up all these countries, these countries had to undertake sharp cuts in imports. And now, in fact, they have had significant balance of payments correction. So German surplus against eurozone periphery has declined rapidly. But overall German surplus has increased, has increased, and this increase is being vis-à-vis the rest of the world. And this matter is actually taken up in a report by the U.S. Treasury, which argues that Germany is generating deflationary bias not only for the eurozone, but for the rest of the world.

Today I think a major underconsumption, underspending problem is in Germany. And unless Germany changes course, unless it expands domestic demand, it inflates domestically, push wages up, there is no way the eurozone periphery can enjoy positive growth or rigorous growth. The only way they can devalue their currencies are by deflating wages–in other words, joining Germany–and suppressing wages, and they’ve already done quite a bit. But German surplus has moved from the eurozone to the rest of the world and become a global problem.

Well, this surplus in Germany is creating deflationary bias to the world economy. And it is actually quite different from Chinese surplus in one respect. And China had 10 percent surplus; now Germany has 7 percent. When China had 10 percent surplus, Chinese imports were booming. Today, Germany has a large surplus and–its imports not booming; its exports are booming, and domestic demand is very sluggish. So Germany is a source of global deflation, and this hasn’t escaped the United States authorities.

FRIES: On that concluding thought, Yilmaz Akyüz, thank you for joining us.

AKYUZ: Thank you

FRIES: And thank you for joining us on The Real News Network.

END TRANSCRIPT

Dr. Yılmaz Akyuz, Chief Economist of the South Center, was formerly the Director of the Division on Globalization and Development Strategies at the United Nations Conference on Trade and Development (UNCTAD) when he retired in August 2003. He was the principal author and head of the team preparing the Trade and Development Report, and UNCTAD coordinator of research and support to developing countries (the Group-of-24) in the IMF and World Bank on International Monetary and Financial Issues. He taught at various universities in Turkey and Europe before joining UNCTAD in 1984 and after his retirement, and published extensively in macroeconomics, finance, growth and development. He is the second holder of the Tun Ismail Ali International Chair in Monetary and Financial Economics at the University of Malaysia, established by Bank Negara.

Originally published at TRNN